Case Study

Case Study

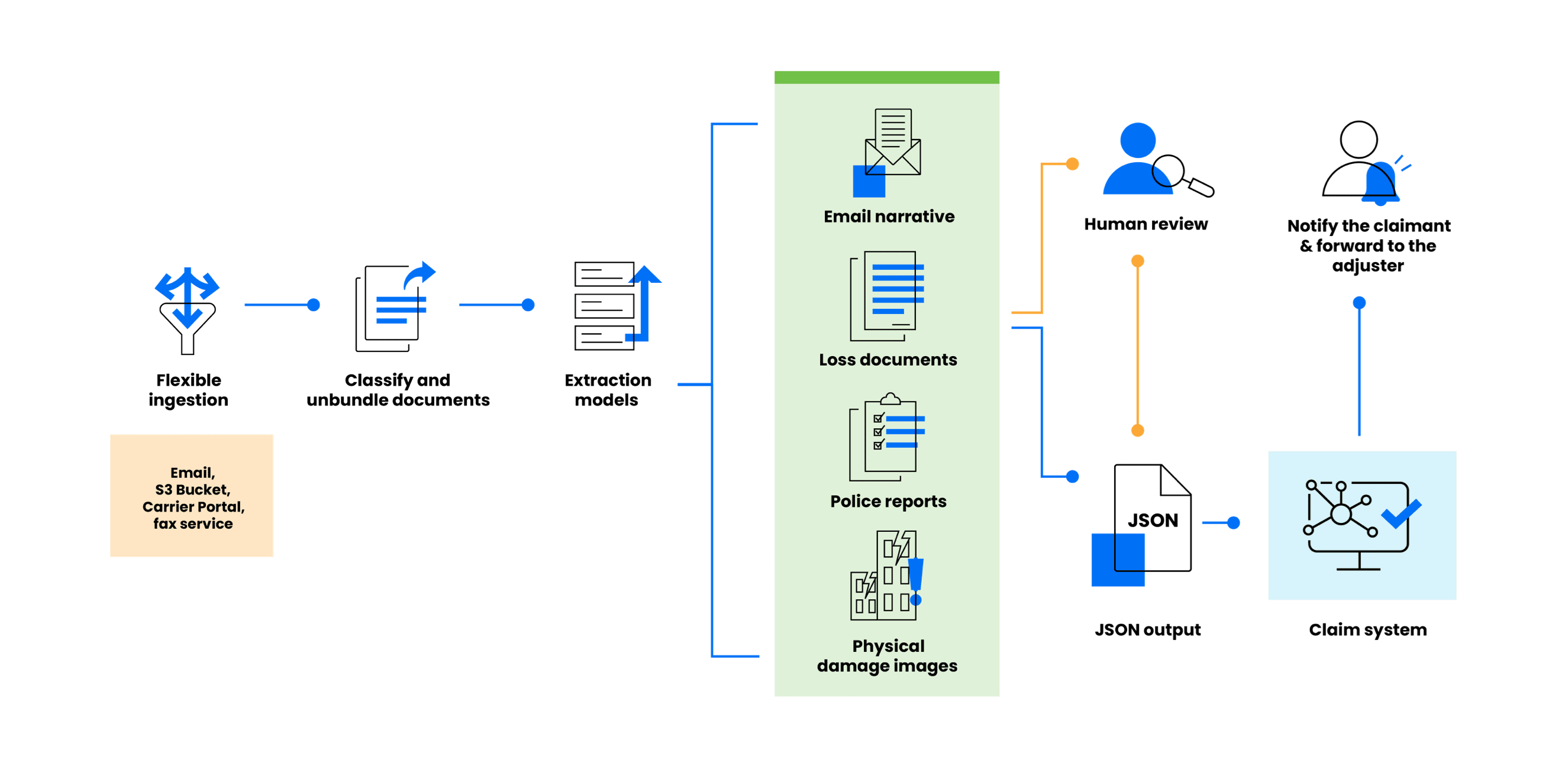

Top 10 Global Insurance Carrier Partners with Indico Data to reduce submission processing time by 80%

More

Case Study

Case Study

$4B+ specialty insurer reaches < 30 second SOV & Loss Run submission processing time with Indico Data

More