Get a demo

Select the type of demo you'd like to experience with Indico Data.

Insurance companies need to process thousands of documents submitted by clients for claims and underwriting, most of them unstructured – and thus out of reach for traditional automation solutions including robotic process automation (RPA), optical character recognition (OCR) and templated approaches to automation.

That leaves carriers with a difficult choice:

It’s clear no matter which choice you make, the status quo is unsustainable. Processing claims and underwriting submissions is currently labor-intensive, creating a drag on productivity and profitability.

A solution lies in intelligent document intake software. A subset of intelligent document processing, intelligent intake solutions apply particularly well to automating document ingestion in the insurance industry. With the right intelligent document ingestion tools, driven by artificial intelligence technology, claims and underwriting process owners can create automation models that handle some 70% of the documents they need to process.

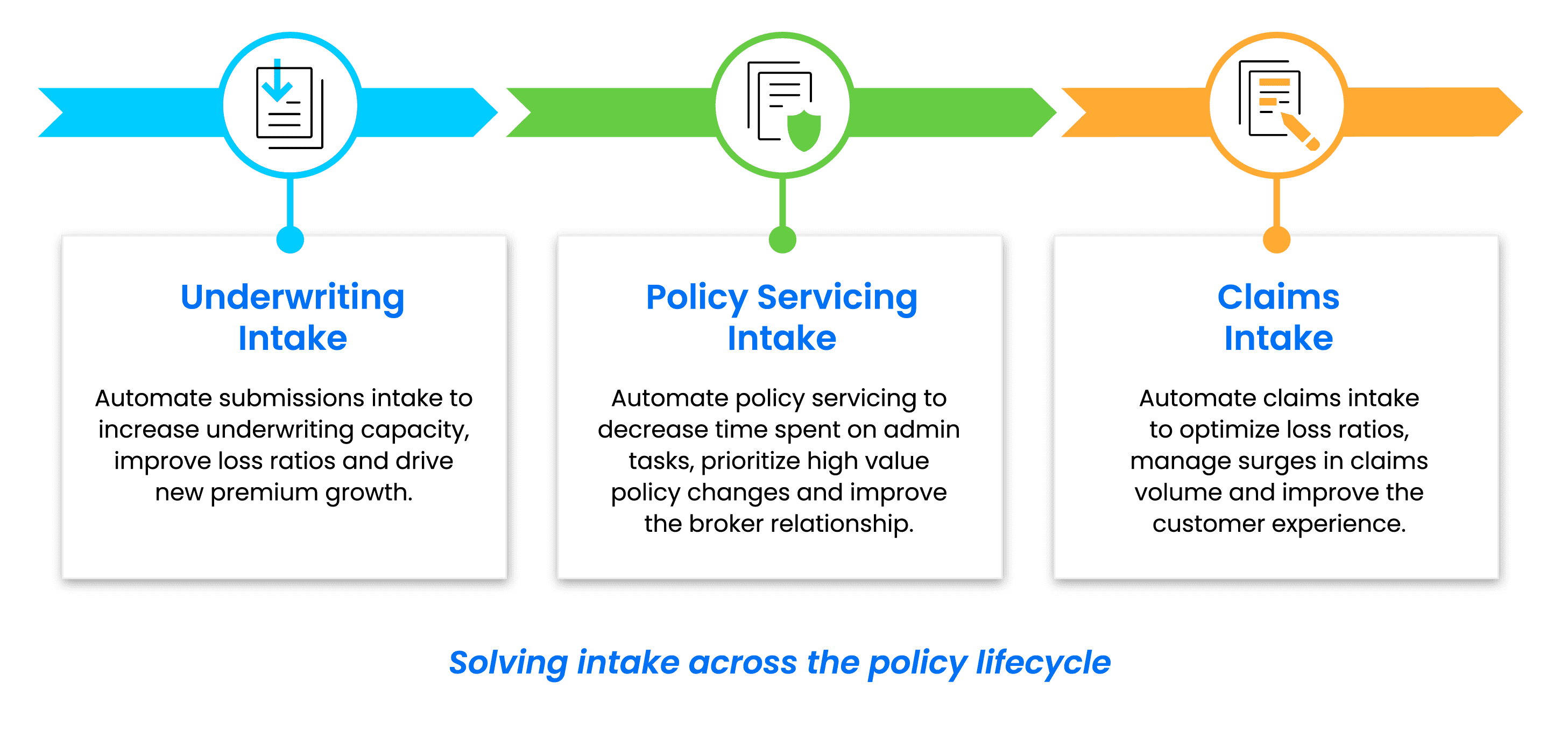

Intelligent intake automation applies to three main areas that involve significant document ingestion for insurance companies: underwriting submissions, claims processing, and policy servicing.

Intelligent intake software helps carriers automate the initial ingestion of data and documents involved in the insurance underwriting submission process. Rather than have associates examine each and every email and document, AI models can process some 70% of submission documents without human intervention.

That has a positive ripple effect on the entire underwriting process. Associates can process more underwriting submissions, thus reducing underwriting leakage; no more leaving potentially lucrative business on the table due to lack of process capacity. Further, the ability to process all incoming submissions enable you to choose those that are potentially most lucrative. It all adds up to improved quote ratios, decreased loss ratios, and improved combined ratios.

Dissatisfaction with claims processing is a major factor driving policyholders to change carriers, with some 74% of unhappy customers in an Accenture study saying they either did change providers or are considering it.

Automated document ingestion can help keep customers happy by enabling carriers to increase claims processing speed and capacity – without increasing headcount. Automating claims document processing removes much of the drudgery involved in poring over documents, which also increases employee satisfaction.

It’s a step toward the ultimate goal of auto-adjudication of claims, which is entirely possible for simple claims. Intelligent intake software also helps carriers more effectively deal with claim surges, such as those following a natural disaster. If intelligent intake solutions can automate, say, 75% of all data intake, that leaves only 25% remaining for manual review – a far more manageable number even in the face of a barrage of claims. It also leaves far less work to be performed by expensive third party administrators (TPAs).

Things change during the course of an insurance company’s relationship with its clients. People move, get married, change names, and maybe phone numbers. Their policy needs may change as well, warranting updates. That’s where policy servicing comes in.

All of these events involve documents that detail the change, no matter if it’s a simple email or a PDF attachment. Customer onboarding is also a servicing function, involving the ingestion of numerous unstructured documents. Here again, intake automation can help.

Occasionally, insurance carriers need to make global updates for clients, such as in response to a regulatory change. A sound intelligent data intake solution will support a “search and compare” function that simplifies the job of finding and updating all policies subject to the change and ensuring they have the appropriate language.

A Fortune 50 insurance provider that serves more than 90 of the top 100 Fortune 500 companies in the U.S. was looking to digitize content accumulated over decades. After hitting a roadblock with RPA, it turned to Indico Data and its intelligent intake solution.

The ability of the Indico platform to read and understand unstructured content, coupled with the ability of the carrier’s employees to build their own models, delivered a quick win. In just a few days, the company was able to process 134,000 documents containing valuable risk modeling data, saving 5,400 employee hours. The company expects the platform to deliver $100 million in savings over the next few years. (Click here to read the full case study.)

A 5,000-employee, Fortune 500 insurance company sought to streamline its underwriting process but hit the wall with RPA because it couldn’t handle unstructured data. After it turned to the Indico Data platform, the company was able to process larger volumes of submissions much faster, without increasing headcount.

The increased processing speed led to a surge of $30 million of new underwriting premiums per quarter. At the same time, the underwriting process is now more accurate and enables the company to be more discerning in the policies it writes, improving both loss ratios and combined ratios. (Click here to read the full case study.)

Intelligent intake is effective because it takes advantage of numerous artificial intelligence technologies, including:

An AI-based automated intake model must be built on a database of labeled data points, enough to give it context behind the task at hand. The Indico Data base model, for example, consists of some 500 million labeled data points, enough to provide context for most any document or image. Thanks to transfer learning, however, it takes only about 200 documents to train the model to perform tasks such as automating intake for insurance claims and underwriting documents.

In practice, a good intelligent intake solution enables insurance companies to build, run, and scale process automation models.

A simple interface enables insurance process owners – not IT – to create custom models that automate various insurance processes. Associates label live, actual documents involved in the process to denote fields they want to extract or examine. It takes only 200 labeled documents to produce a working model.

An intelligent intake platform should have tools that predict the degree of accuracy your model will deliver as you build it. To increase accuracy, simply label more documents.

The platform should also make it easy to understand how the model behaves, which gets to the concept of “explainable AI.” That makes it easier to understand why the model makes the decisions it does and to remediate any issues.

Once the model is in production, it’s helpful to have a staggered loop learning function to improve its accuracy over time. This involves human-in-the-loop feedback to correct any mistakes or approve questionable decisions, feedback that is then fed into the model to improve it going forward.

Over time, staggered loop learning means you continually extract data more accurately, which leads to faster, more accurate decision-making.

Additionally, the models should produce data that help you understand key metrics such as return-on-investment (ROI) and straight-through processing (STP).

Finally, an intelligent intake platform should have features that promote scalability, so you can apply it to various use cases across the enterprise.

Such features include the ability to support diverse types of content, both structured and unstructured, including dense text (including emails, Word, and PDF documents), tables, images, and various languages. Indico Data, for example, supports more than 80 languages.

Support for out-of-the-box accelerators that address common use cases with no additional training is another plus. They should also be able to be deployed alongside custom models.